Solo 401k Employee Contribution Limits 2025 - You can make solo 401 (k) contributions as both the employer and employee. Solo 401 (k) contribution limits. TotalSolo401kContributionLimitsfor2023and2025 My Solo 401k, (those limits will jump to $23,000/$30,500 for 2025.) as an employer, he can also make additional contributions up to 20% of adjusted net earnings. Workers age 50 or older can kick in additional amounts.

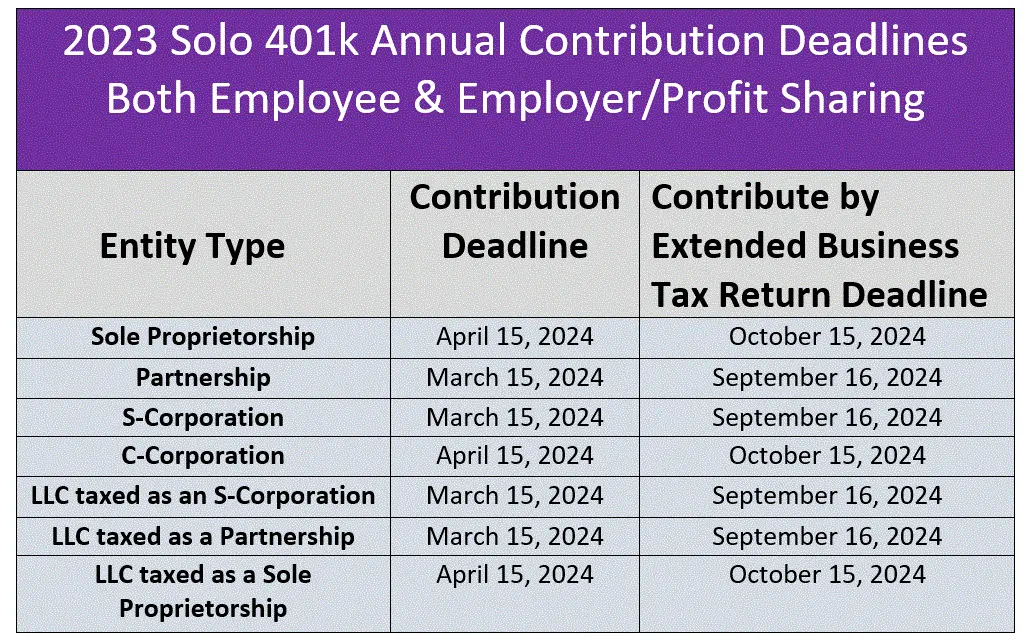

You can make solo 401 (k) contributions as both the employer and employee. Solo 401 (k) contribution limits.

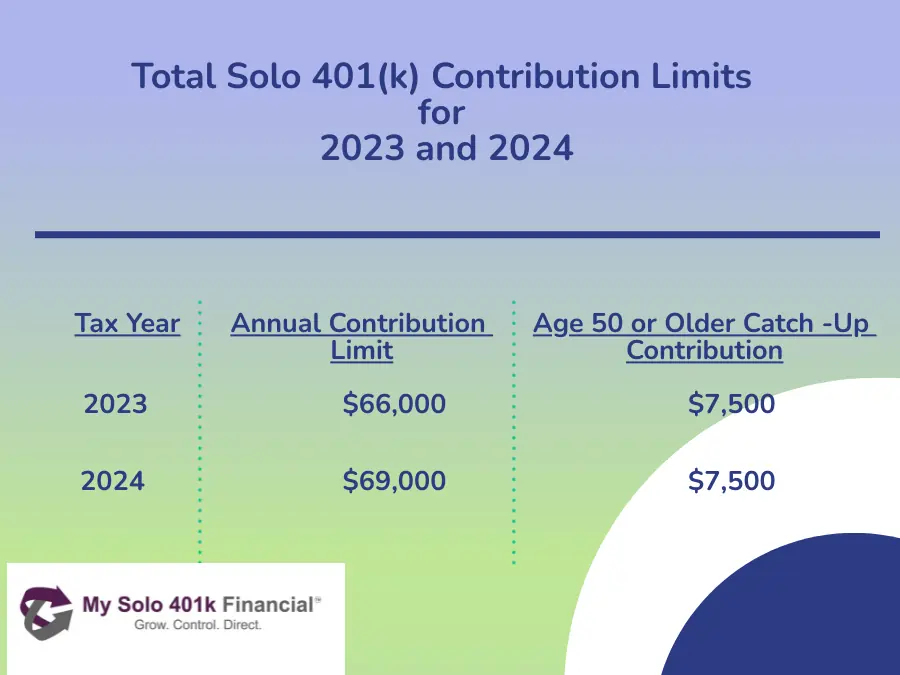

Solo 401k Contribution Limits for 2025 and 2025, If you're age 50 or. For 2023, that limit is $66,000.

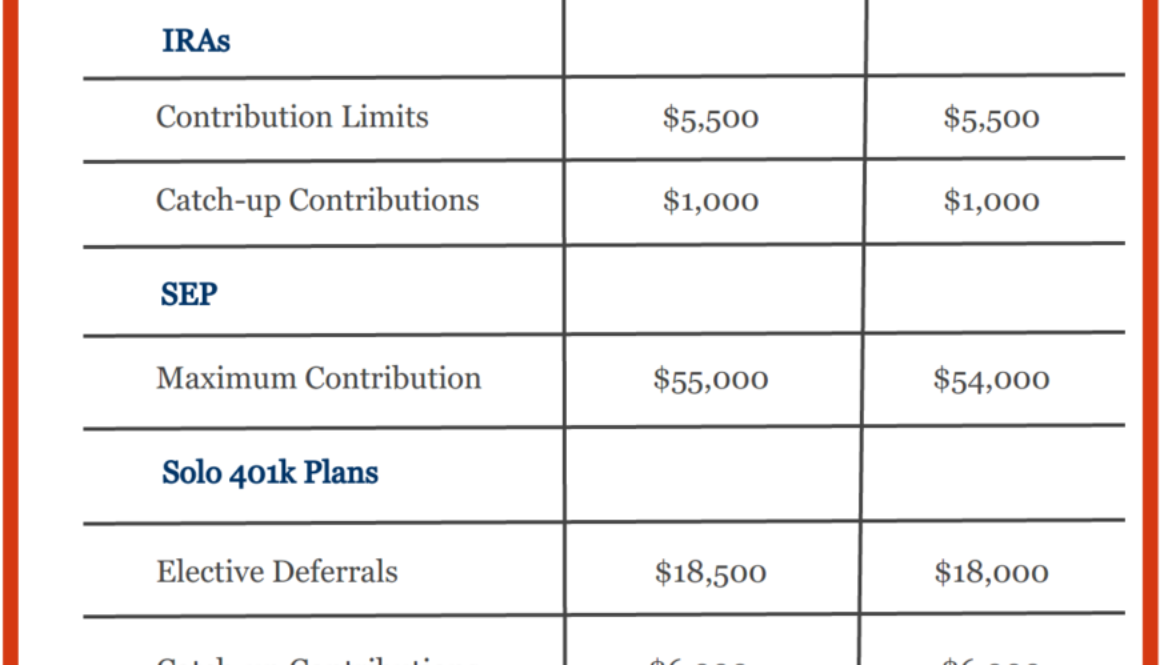

Infographics IRS Announces Revised Contribution Limits for 401(k), Find out how much you can contribute to your solo 401k with our free contribution calculator. As an employee in 2025, you can make salary deferral contributions of $23,000 or 100% of compensation,.

Northern Lights Winnipeg 2025. The northern lights are expected to be more active in 2025. […]

For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older.

For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at least age 50.

solo 401k contribution limits and types, This limit is per participant. Solo 401 (k) contribution limits.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, Solo 401 (k) contribution limits. (those limits will jump to $23,000/$30,500 for 2025.) as an employer, he can also make additional contributions up to 20% of adjusted net earnings.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, For 2025, the max is $69,000 and $76,500 if you are 50 years old or older. What are the new solo 401k contribution limits for 2025?

Solo 401k Rules Solo 401 k Small Business, The roth solo 401 (k) contribution limit for 2025 is $23,000 for employee contributions. (those limits will jump to $23,000/$30,500 for 2025.) as an employer, he can also make additional contributions up to 20% of adjusted net earnings.

Wwe Current Roster 2025. Champions on each brand will be protected and are not eligible […]